Sales of products containing cannabidiol (CBD) have been brisk over the past two years, pacing rising consumer awareness of the substance and greater availability of hemp-derived CBD products beyond the regulated dispensary channel. This robust but fledgling market holds opportunities for companies already in the cannabis space, consumer packaged goods companies and makers of pharmaceuticals.

BDSA estimates CBD product sales in the United States reached nearly $2.7 billion in 2019 in all channels—dispensary, general retail and pharmaceutical. Sales are forecast to reach $4.3 billion in 2020 and $20.5 billion in 2025. The market is expected to see a compound annual growth rate (CAGR) of more than 40% between 2019 and 2025.

The emergence of the COVID-19 pandemic in early 2020 had a severe impact on retail sales in general but a minimal damping effect on overall sales of CBD products. Channels such as natural products/vitamin saw volume shift to ecommerce rather than decline overall. BDSA’s outlook on channels such as restaurants was conservative so the shutdown of on-premises consumption had minimal impact relative the forecast for those channels.

Prior to the pandemic, BDSA retail tracking showed a shift of spending from CBD inhalables to sublinguals, largely due to the late-2019 e-cigarette or vaping product use-associate lung injury (EVALI) crisis. This combined with the pandemic is expected to have a continued near-term impact on the CBD inhalables product category—with sales shifting to wellness and other categories.

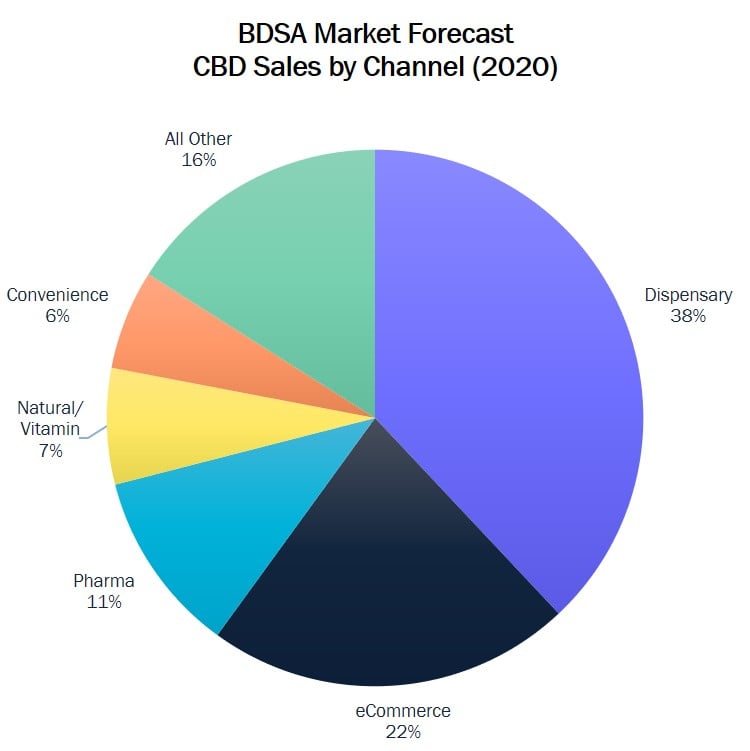

The dispensary channel will continue to be the single largest outlet for CBD products in the U.S. through 2025, with ecommerce immediately behind it. Even so, other key retailer types are expected to grow share significantly over that time—and that trend will accelerate when the Food and Drug Administration approves CBD as a food additive in the U.S., as BDSA expects it to do in 2021 or 2022.

In 2020, dispensary and ecommerce combined are forecast to account for 60% of total CBD sales in the U.S. That combined share is forecast to drop to 44% in 2025 as other distribution channels grow. Natural foods and vitamin outlets, mass-merchants and grocery stores will each account for between 8%-9% of total U.S. CBD sales in 2025.

Prescription CBD drugs, such as Epidiolex, are sold through pharmacies. This channel is expected to account for about 11% of total CBD sales in 2020 and gain just one point of share over the forecast period, though total sales will increase considerably over that time. BDSA expects the FDA to approve additional CBD-based pharmaceuticals within the forecast timeframe.

{{cta(‘953fb0c4-2e32-4e68-b043-da55f0c4528e’)}}

BDSA’s CBD forecast covers the United States, Canada and the United Kingdom. The model forecasts total demand across 10 CBD product categories in 12 major distribution channels and is powered by transactional-level data collected by BDSA from legal cannabis dispensaries in the U.S. and Canada, similar data from the general retail channels collected by BDSA partner IRI, as well as data from industry/association, government and other key sources.

Recent Post

- Fastest Growing Disposable Vape Brands

- Maximizing 4/20 Success: Insights and Strategies for Cannabis Retailers and Brands

- Emerald Earnings: St. Patrick’s Day’s Surprising Impact on Cannabis Sales

- Small Categories, Big Wins: How to Optimize Cannabis Retail for Valentine’s Day

- Redefining Growth: Innovative Strategies for Cannabis Brands in a Price-Compressed Market