Infused gummies make up 84% of candy ingestible sales in 2020

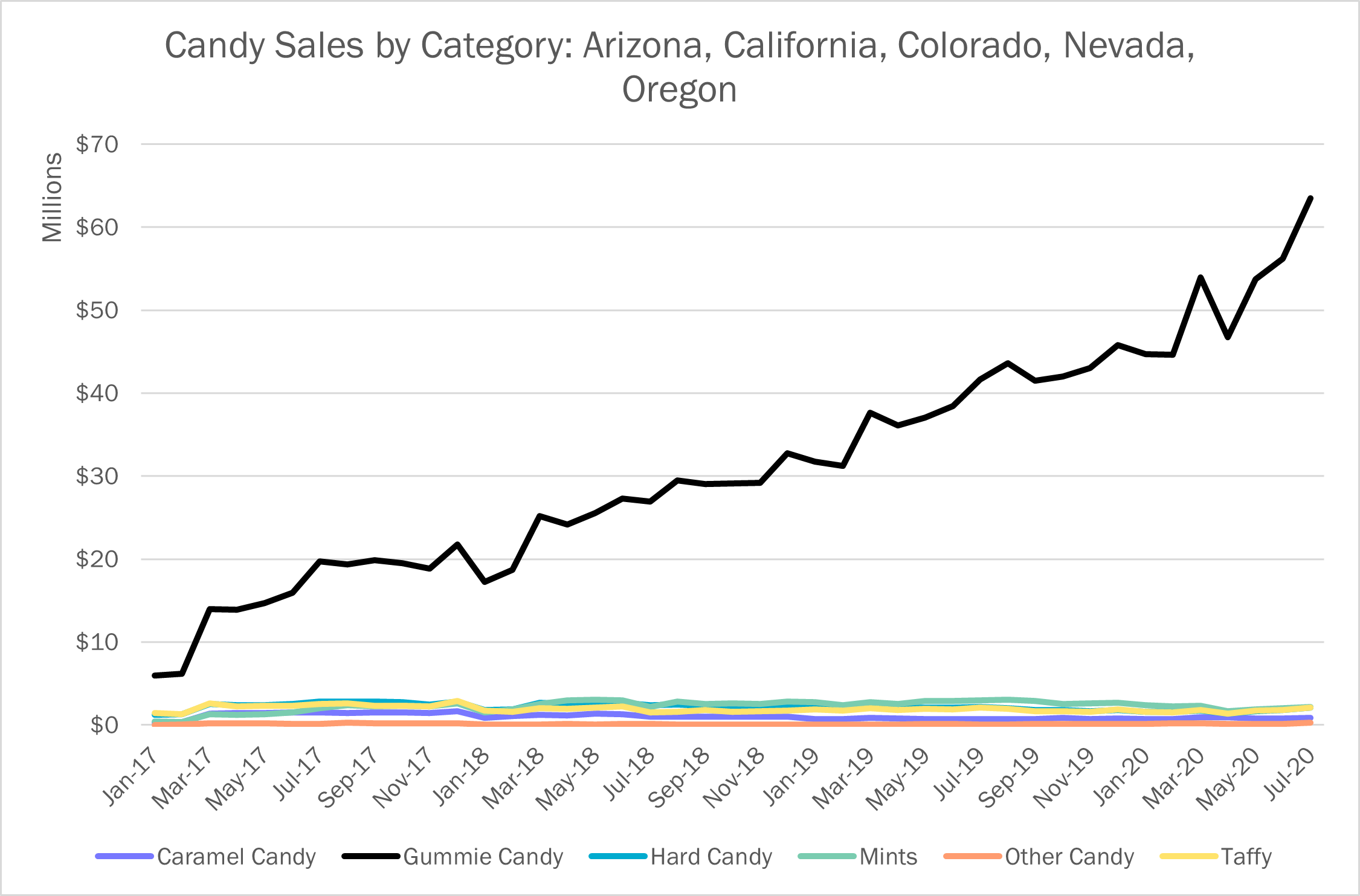

While sales of ingestible cannabis have grown steadily in legal markets, candies have seen particularly strong sales, with infused gummies making up 84% of candy ingestible sales so far in 2020 across Arizona, California, Colorado, Nevada and Oregon. Overall gummy sales in these 5 states have seen strong growth in recent years, from $20 million in July 2017 to almost $64 million in July 2020, a growth rate that far exceeds that of other candy ingestibles. The familiar form factor and multitude of flavors that gummy products present make them especially appealing to consumers, who report that the product type is their favorite type of ingestible cannabis.

BDSA Consumer Insights data from Q1 2020 shows that gummy candies are the most widely used and most popular ingestible product category for adult-use consumers in the US and Canada. 60% of US edible consumers report past 6-month use of infused gummies, compared to 54% of Canadian edible consumers. This lower percentage of reported use by Canadians surveyed holds true across most ingestible product categories. Baked goods, which were the next most popular ingestible product, saw past 6-month consumption rates of 46% in US consumers and 39% in Canadian consumers.

Gummies are also the most preferred edible product by a wide margin, with 33% of US and 31% of Canadian ingestible consumers citing gummies as their preferred type of edible. The next most popular ingestible products, baked goods, were preferred by 18% of US and Canadian consumers.

The lower rate of gummy consumption by Canadians is likely a result of the delayed launch of most ingestible cannabis products in the Canadian adult-use market. This assumption is supported by the fact that edible oils, one of the few ingestible products available to Canadians at the launch of adult-use sales on October 17, 2018, saw a past 6-month consumption rate of 21% for Canadians, compared to 13% for US consumers. Another factor for the slower growth of edible consumption in Canada may be the relatively low 10 mg THC limit per package that has been imposed by Canadian regulators. While this stringent regulation may seem like a factor to dissuade consumers, BDSA’s data shows that 47% of Canadian consumers prefer ingestibles containing 10 mg THC or less, while 21% do not know how much THC they prefer, suggesting that potency is less of a deal-breaker for consumers than other characteristics that gummies offer, such as convenience, discretion and taste.

BDSA Consumer Insights data shows that ease of use and flavor options are the top reasons for ingestible consumers to prefer gummies, with 38% of US ingestible consumers in adult use markets citing these as the reason they prefer gummies. Canadian consumers show a similar dynamic, with 39% citing ease of use as their reason for preferring gummies, while 37% cite flavor options. This suggests that the rising popularity of gummies may be due to the same factors that lead consumers to prefer vapes, which have also seen massive growth in legal markets. The dual benefits of offering a convenient, discrete form of consumption with a wide range of flavors to suit any consumers taste seem to be a key factor leading to the success of gummy products.

While concerns about dosing and cannabis gummies being too appealing to children have made regulators uneasy, it is not likely that these concerns will hamper the growth of gummy sales for years to come. The familiar, easy to use form factor and flavor options that gummies present make the product appealing to consumers, even as innovation in the industry has led to a much wider variety of other ingestible products than were previously available. With the appealing characteristics that they present to consumers, cannabis gummies are expected to take up a larger market share of ingestible sales and become a driving force for total legal ingestible sales for years to come.

Recent Post

- Fastest Growing Disposable Vape Brands

- Maximizing 4/20 Success: Insights and Strategies for Cannabis Retailers and Brands

- Emerald Earnings: St. Patrick’s Day’s Surprising Impact on Cannabis Sales

- Small Categories, Big Wins: How to Optimize Cannabis Retail for Valentine’s Day

- Redefining Growth: Innovative Strategies for Cannabis Brands in a Price-Compressed Market