Whether or not you keep up with the cannabis industry, you’ve likely heard the term “CBD” recently. Seemingly overnight, CBD is appearing everywhere from beauty product lines to burger joints. As it turns out, there’s legitimate reasoning behind “today’s” latest hype.

Cannabidiol, more commonly known as “CBD,” is one of over a hundred naturally occurring phytocannabinoid compounds found in the makeup of the cannabis family of plants and has been the subject of scientific research since the 1940’s. It’s not a new concept. The recent rise in use and popularity can be primarily attributed to the onset of cannabis legalization across the United States, and most recently, the passage of the 2018 Farm Bill, which legalized the cultivation of hemp – cannabis with less than 0.3 percent THC by weight.

CBD Market Monitor

According to the newest service offered by BDS Analytics, CBD Market Monitor, U.S. sales of cannabis- and hemp-derived CBD products are expected to surge to $20 billion by 2024. With sales of only $1.9 billion in 2018, the forecasted 49% compound annual growth rate (CAGR) through 2024 is staggering.

CBD Market Monitor tracks current and ongoing retail sales as well as consumer behavior. Retail tracking and forecast models include products sold through licensed dispensaries, pharmaceuticals and in general market retail, encompassing the full CBD market of 11 broad distribution channels and 10 categories of CBD products types.

The use and sale of CBD products within the legal cannabis market has maintained a significant lead against other markets. Dispensaries accounted for 65 percent of all CBD dollar sales in 2018, with Ingestibles (predominately tinctures and candy) and Topicals (creams, balms, salves, and patches) leading in product popularity. It is also interesting to note that the share of high-CBD (as opposed to high-THC) product sales within dispensaries has also experienced a sharp uptick; In markets tracked by BDS Analytics’ GreenEdge™ Platform, CBD sales accounted for 11 percent of 2018 total dispensary sales—a considerable increase from just 5 percent in 2017.

Non-dispensary retail channels are expected to rise rapidly over the next five years. General retail categories such as mass merchants, eCommerce, grocery, drug and others will likely account for a larger proportion within that time period—capturing 74% of CBD total sales by 2024. The natural products channel is an early leader among general retail channels, with significant spending growth over the forecast period.

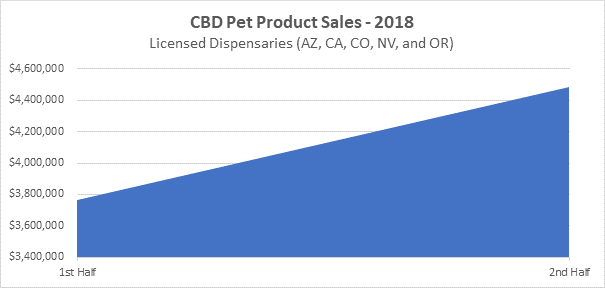

Pet products have also seen a rise in popularity. The second half of 2018 recorded sales in licensed dispensaries within Arizona, California, Colorado, Nevada and Oregon observed an increase of 19% in CBD infused pet products.

Who’s Buying?

Consumer markets are expected to grow in alignment with overall sales growth. Though current consumer penetration for hemp-derived CBD products in the U.S. is still only 15 percent, the expanded availability of products is expected to result in a significant rise in consumer use within the next six to twelve months. The average U.S. hemp-derived CBD consumers are:

- 50 percent female, 50 percent male

- Aged 40 to 45

- Have attained higher education

- More likely to be employed full-time

It is interesting to note these profile attributes when taking into consideration that 54 percent of U.S. adults (21+) overall do not understand the difference between THC and CBD, and 59 percent are confused over the perceived effects of hemp-derived products.

The Road Ahead

Advocates of CBD claim an array of health benefits, from pain to acne relief. As a result of the rise of these products in the marketplace, the U.S. Food and Drug Administration (FDA) has issued public statements warning manufacturers about making unapproved drug claims. The sale of unapproved products with unsubstantiated therapeutic claims is not only a violation of the law, but also poses a significant health risk to consumers, as it may prevent individuals from seeking appropriate, recognized therapies to treat serious and even fatal diseases. Despite these risks, there have been recent successes in the approval of cannabis-derived drugs, most recently with the approval of Epidolex, a drug treatment of seizures associated with two rare and severe forms of epilepsy.

What About Other Known Manufacturing Obstacles in Play Today?

CBD product manufacturers are currently faced with a significant – and wholly uncharted – hurdle with gaining FDA clearance for all food and natural product lines prior to hitting the market. Despite CBD appearing in many ingestible products, from coffee to cake, the FDA has issued a very clear directive that it does not consider CBD to be a safe food additive. The Farm Bill only cleared the road for hemp-based CBD to be included as an ingredient in a range of non-food products. Likely as a result of the CBD boom, the FDA has now announced it will hold hearings on hemp-derived CBD as a food additive at the end of May—indicating it may reconsider its position.

Though CBD remains a product of regulatory-limbo for the time being, there is no question, this is only the beginning of what is sure to be an interesting—and perhaps appetite-inducing—market journey.

Recent Post

- Fastest Growing Disposable Vape Brands

- Maximizing 4/20 Success: Insights and Strategies for Cannabis Retailers and Brands

- Emerald Earnings: St. Patrick’s Day’s Surprising Impact on Cannabis Sales

- Small Categories, Big Wins: How to Optimize Cannabis Retail for Valentine’s Day

- Redefining Growth: Innovative Strategies for Cannabis Brands in a Price-Compressed Market